Giving

Charitable Gift Annuities

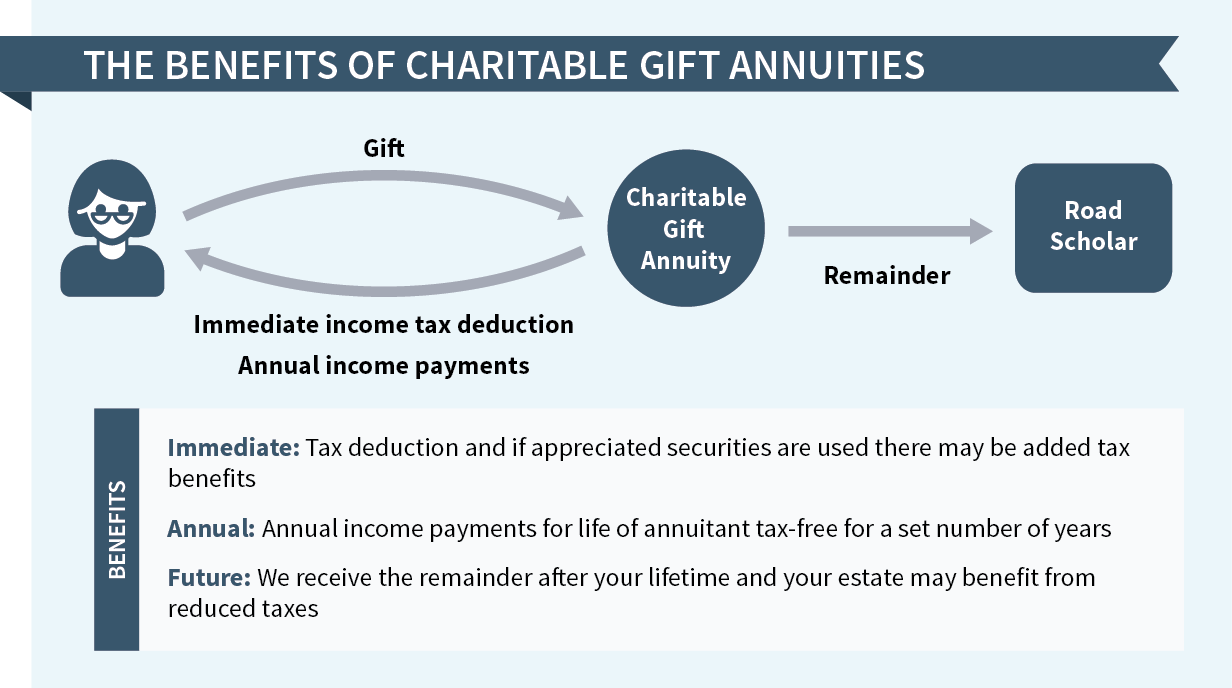

A gift annuity is a simple contract between you and Road Scholar — you make a gift using cash, marketable securities or other assets, and we, in turn, pay you a fixed income during your lifetime. This is a wonderful tax-advantaged way to provide reliable income during your retirement years. When your gift annuity ends, its remaining principal passes to Road Scholar helping to ensure the future vitality of the organization and our educational programs for older adults.

FOR MORE INFORMATION

A charitable gift annuity provides you and/or your beneficiary(ies) with income for life. The income rates are based on your age or the age(s) of your beneficiary(ies) and the timing of your gift. To take advantage of these benefits and to begin planning your gift, please contact Ann Lamond, Director, Planned and Major Gifts, toll free at (877) 737-0664 or fill out this form.

NEW INCREASED PAYOUT RATES (EFFECTIVE JANUARY 1, 2024)

|

||||||||||||

|

||||||||||||

Consider the Benefits

Beyond increasing your retirement income, as you help secure Road Scholar’s future, gift annuities offer you additional tax benefits, including:

-

An immediate charitable income tax deduction when you itemize

-

Part of each payment is income tax-free throughout your estimated life expectancy

-

Capital-gain tax savings when you use appreciated securities to fund your gift

- Higher income when payments are deferred

ASSETS USED AND MINIMUM GIFT

Charitable gift annuities are typically funded with cash and marketable securities. A minimum gift of $10,000 is required to establish a charitable gift annuity with Road Scholar.

Like a charitable gift annuity, a deferred charitable gift annuity is an irrevocable gift that provides for an immediate charitable deduction and fixed income payments for life for one or two income beneficiaries. Income payments must be deferred at least one year after the gift date.

Charitable remainder trusts are a time-tested way to provide for Road Scholar’s future while you satisfy personal and family financial needs. They offer increased income, set aside funds for family members and provide tax relief, with the added benefit of supporting Road Scholar.

We offer two types of charitable remainder trusts: charitable remainder unitrusts and charitable remainder annuity trusts.

The Planned Giving Calculator is easy to use! It is designed to provide you with an illustration of the income and tax benefits to which you may be entitled if you make a planned gift to benefit you and Road Scholar. Simply enter the relevant information in the spaces provided below and the calculator will estimate your benefits.

For more information about gifts that pay you income please go to our Ways to Give webpage or contact Ann Lamond, Director Planned and Major Gifts, toll free at (877) 737-0664 or fill out this form.

Elderhostel Inc., dba Road Scholar charitable gift annuities are available in most states and follow the rates suggested by the American Council on Gift Annuities. No legal advice is provided and individuals should seek the advice of their own legal counsel.